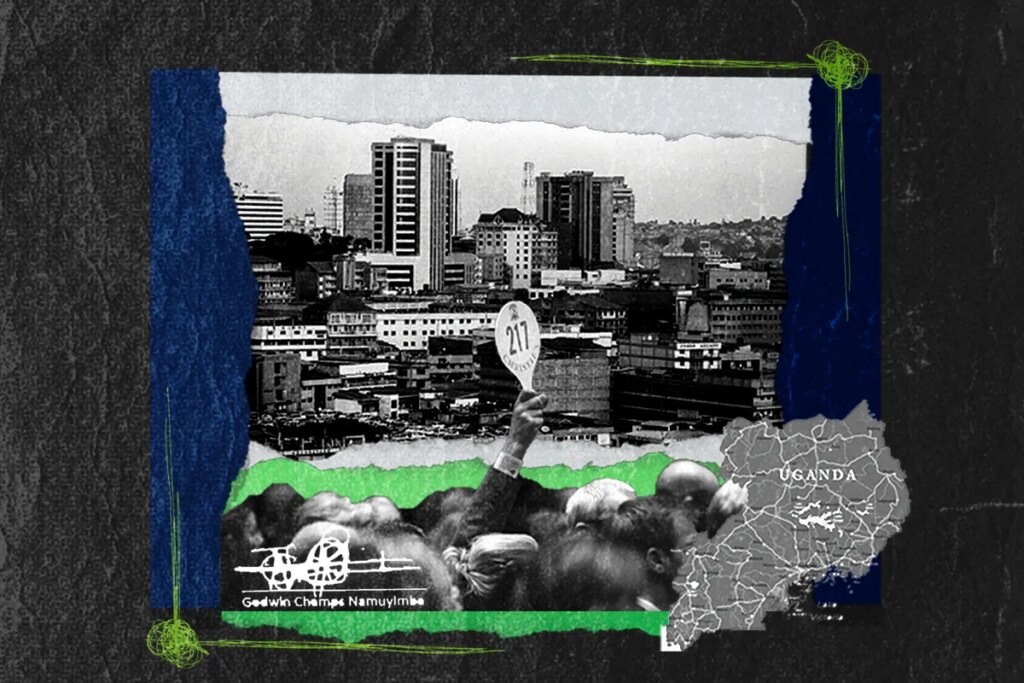

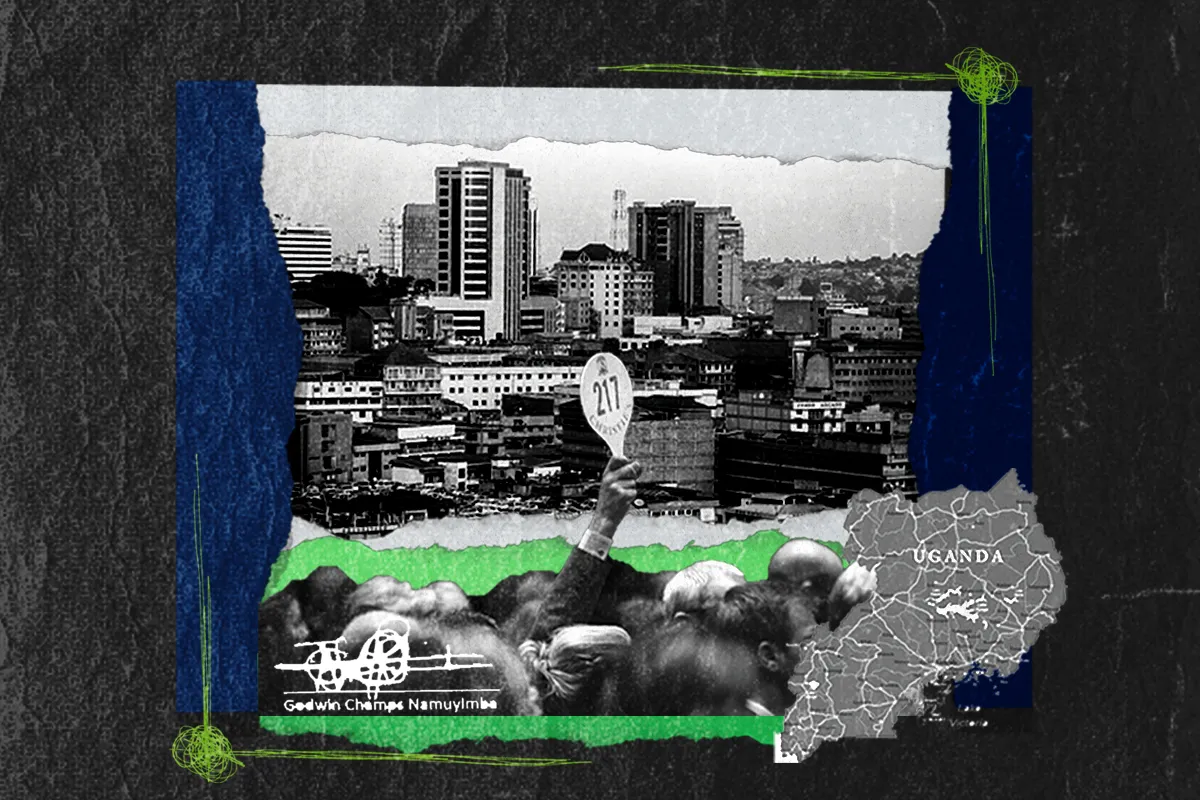

Early in 2022, painter Godwin Champs Namuyimba was furiously finishing works for a solo exhibition at Galerie Marguo in Paris. Though prices for his works at auction had recently exceeded $160,000, Namuyimba was still living and working in a two-bedroom apartment in a hotel complex in Masaka, the small city in southern Uganda where he was raised. The apartment walls were bare—his landlord made him agree not to hang anything—and he painted on imported unstretched Belgian linen as he sat on the floor. Outside his home in Uganda, whether in Masaka or Kampala, the country’s capital and the center of its art scene, few had ever heard of Namuyimba, despite the fact that prominent international collectors and dealers owned paintings of his whose auction prices surpassed ten times their sales estimates in just a few months.

All this might be unremarkable, yet another artist’s unexpected rise at auction outpacing the more traditional markers of a career. But in June 2022, Galerie Marguo opened Namuyimba’s solo exhibition in Paris, while shortly thereafter another show opened in London: a showcase of his works by the art advisory firm Art Intelligence Global (AIG), founded by ex-Sotheby’s heavyweights Adam Chinn, Amy Cappellazzo, and Yuki Terase. The dueling shows were evidence that Namuyimba’s appearance at auction sales and in galleries and fairs from New York to Paris was far more complicated than was generally known at the time. Interviews with those in the artist’s social circle and his monied collectors revealed how Namuyimba leveraged collectors’ demand for undiscovered artists from the Global South to his financial benefit. (Galerie Marguo has asserted that Namuyimba claimed he had no involvement in the AIG show; Namuyimba declined to comment on this and on other specific queries related to the claims in this article.) It worked, until it fell apart: within a year of the two shows, Namuyimba’s auction prices fell back to earth, from a high of $168,000 in 2021 to £10,160 ($12,925) this past July. All in all, Namuyimba’s rise and fall offer a glimpse into art market speculation and a cautionary tale for artists.

Twenty years ago, it was typical for an artist to be discovered the old-fashioned way, in group exhibitions at small galleries or small nonprofit spaces. Social media upended all that and, in recent years, Instagram has become a sales platform and a point of discovery for many artists, especially for those hailing from Africa and other locales that are distant from international art centers and have less access to representation by established galleries. In 2016 the Financial Times reported that a new generation of African artists outside established art scenes, like those in South Africa and Nigeria, could now live and work within their home countries, thanks to the ability to promote artworks online. Namuyimba took advantage of such resources; by 2019, he had a large body of work and a following on Instagram, and art world cognoscenti were turning to Africa’s many art scenes in the search for talent.

This coincided with a renaissance in Black figurative painting, a trend that had hit an inflection point the year prior. Early in 2018, Bloomberg reported that, as part of a course correction of art history to include artists of color, Black art had become the subject of a “gold rush,” with billionaire art collectors like Ken Griffin and Steve Cohen, along with nearly every major museum, making a push to acquire such works. That year, Kerry James Marshall’s work hit $21 million when Sean Combs purchased one of his paintings at auction. The following year, Ghanaian painter Amoako Boafo, who’d started out selling his paintings in Accra for $100, became an unexpected megastar when he received a residency at the Rubell Museum in Miami, an endorsement that has been known to anoint artists’ commercial success. His work became the subject of speculation among collectors and dealers, and prices for his work at auction reached into the millions. Numerous other young artists’ works rose spectacularly at auction during the speculative frenzy for “ultracontemporary” art that started during Covid lockdown and ran aground earlier this year, when recession fears blew troubling economic winds through the art market.

Namuyimba’s story shows how that speculative frenzy ended up affecting not only him, but the group of early collectors and dealers closest to him. If the market is like the weather, as one top dealer is fond of saying, this is a story with peeks of sunshine but otherwise a whole lot of rain.

In the fall of 2019, some of those who were buying Boafo’s work discovered Namuyimba. The first to find him was Bo Fornstedt, a Swedish collector in his seventies who came across Namuyimba’s Instagram. Fornstedt had been an early backer of Boafo and other African artists—his connections helped Boafo present a solo show at Gagosian gallery in New York—and he believed in Namuyimba’s potential. He saw the work as distinctly “local” in comparison to Boafo’s, whose work he believed had moved away from its Ghanaian context in the course of Boafo’s European formal education. Fornstedt began messaging with Namuyimba and acting as an informal mentor, and though the two never met in person, he worked that November with Swedish dealer Jeanette Steinsland to stage Namuyimba’s first solo exhibition at Gallery Steinsland Berliner, a Stockholm gallery known for promoting edgy, less-salable emerging artists. “He was such a vibrant painter,” said Fornstedt, who owns Rescue, a Namuyimba painting of a haloed figure. “I tried to help him. He didn’t have anything.”

In February 2020, Fornstedt introduced Namuyimba’s work to another Swedish collector, Bjorn Stern, who a couple years earlier had started an artists’ management bureau in Brussels called Stjarna Art. Stern comes from an art collecting family, and wanted to help artists who weren’t fluent in the arcane system of galleries, institutions, and auction houses. The idea was to assist them in developing their careers to the point where they could find formal representation with an established gallery. Namuyimba was the perfect client.

Around the same time, Paris-based art dealer Anne de Villepoix reached out to the artist about doing another solo show later in the year. The following month, Namuyimba was included in a group show at La Loma Projects during Frieze Los Angeles. Shortly after, however, the world went into pandemic-related lockdown. De Villepoix had to postpone Namuyimba’s show. She had bought a group of his works for less than €5,000 (around $5,400) each, according to a source close to the sale—another source close to Namuyimba at the time put the price closer to €1,000 each—and she showed them to collectors to gauge demand. By May, she had sold four paintings. But, in July, her commercial relationship with Namuyimba soured when he failed to produce five additional works needed to mount the exhibition, she told ARTnews. One source who worked with Namuyimba at the time said that de Villepoix, for her part, did not manage to secure a visa for the artist to come to France. According to two sources, visa issues continued to prevent dealers from flying Namuyimba out of Uganda. (De Villepoix declined to comment on her relationship with the artist.)

Fornstedt and others said they explained to Namuyimba how the market could work for an artist who wanted a sustainable career, with strategic sales of paintings to reputable collectors who wouldn’t sell them at auction. Doing so, they explained, helps emerging artists keep their prices low at first in order to create a long-term, stable rise that wouldn’t overwhelm the market and then evaporate.

But Namuyimba needed money, especially during the pandemic, according to two collectors he confided in at the time. He began approaching collectors for funds, telling several of them he wanted to purchase land in Masaka that he could develop into a shopping mall or hotel complex. In Uganda, owning land is a clear marker of financial success. Namuyimba grew up poor and, according to sources close to him, was fixated on transcending his working-class status. With European and Asian collectors buying his work, and galleries in other countries staging exhibitions, he saw buying property in Masaka as the next step. In one case, he arranged a more informal agreement with a collector to front $20,000 to help with the land purchase, with two artworks to be sent later in exchange. The funds were wired, but some three years later, that collector has yet to receive the paintings, the collector told ARTnews. Namuyimba declined to comment on the deal.

In fall 2020, Namuyimba signed an exclusive management contract with Stjarna Art, which included a stipulation that the artist no longer sell works directly from the studio, in order to ensure market predictability, the firm told ARTnews. Stern then worked to craft a long-term vision for the artist. He placed Namuyimba’s work in a group show at Colnaghi Gallery in London that explored dreams and technology and put his work in conversation with that of contemporary artists like Raqib Shaw, Andy Warhol, and Salvador Dalí. Stern traveled to Masaka and Entebbe multiple times to meet with Namuyimba, see his work, and help guide his career.

A Ugandan Painter’s Rise From Obscurity Reveals What Can Happen When the Art World Enters the Global South, Page 1 of 4